International Benchmark of banking apps

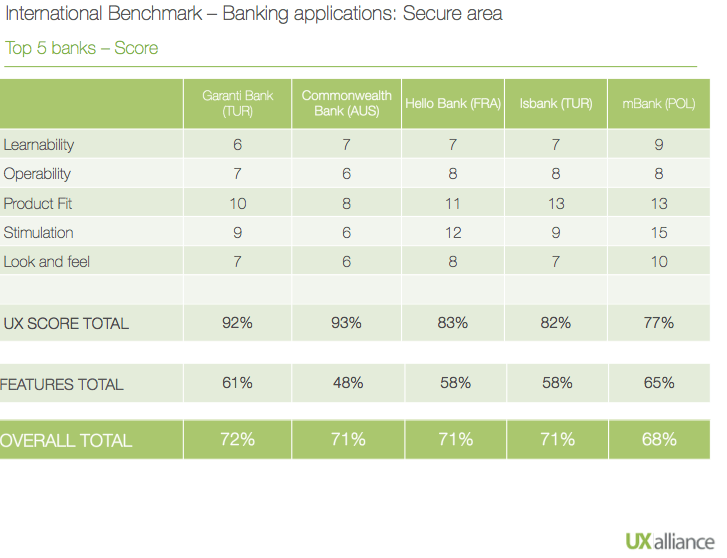

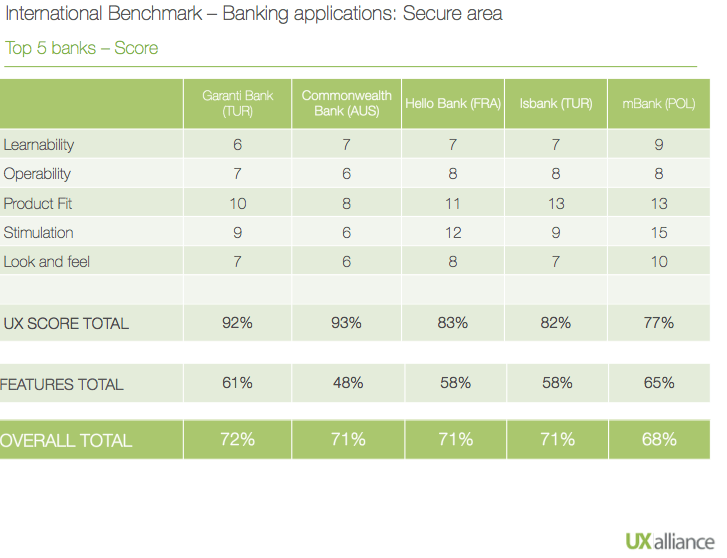

The UXalliance undertook to do an international research benchmark to gain insight into the offering banks have in regards to their app environment.

The study evaluated the various service offerings as they pertain to banking apps allowing a holistic view of the international industry at large as well as the top players in the field. We assessed a number of features and functionalities offered on the banking apps in order to identify trending functionality and best practices in the banking app within both the secure and unsecure environments.

The focus was on the landing pages and navigation for both areas within the individual apps, as well as registration and login in the unsecure area. Additionally, any features which were thought to be of note were included in the benchmark. 20 UXalliance partners participated in the study which included 40 banks from across the world.

Here some of the trends in banking engagement

- Login: speak pre-existing phrases to activate transaction functionality eg account balance

- Read barcode on your bills with your camera and pay them

- Share your bills with others

- Deposit a cheque in your account with a camera view

- Collect invoices or bills from your camera

- Pay through paypal

- Send money to a person with a Facebook account

- Buy lottery tickets and access coupons

My winning feature?

The Cardless Cash, from The Commonwealth Bank in Australia, that allows to make ATM cash withdrawals without the need for a card, simply by using the CommBank app. In emergencies, you can even arrange for someone else to collect the money on your behalf by nominating them through the app.

We’ll be glad to present this study, please contact: info@yucentrik.ca

0 Comment(s)